Bridging the Global Trade Data Gap with Mirror Data

In the vast universe of trade data, 15% is hidden in the shadows of deliberate non-reporting or tardy and erratic disclosure. Fortunately there are ways of peering into the dark matter and drawing accurate conclusions about trade flows and trends.

Similar to astronomers coaxing evidence of impossible to see planets and black holes out of measurements of visible objects affected by them, the Observatory of Economic Complexity (OEC), utilizes a strategy for revealing undisclosed transactions economists call mirror data. Trade data reported by partner countries is reverse analyzed to estimate the exports and imports of non-reporting nations.

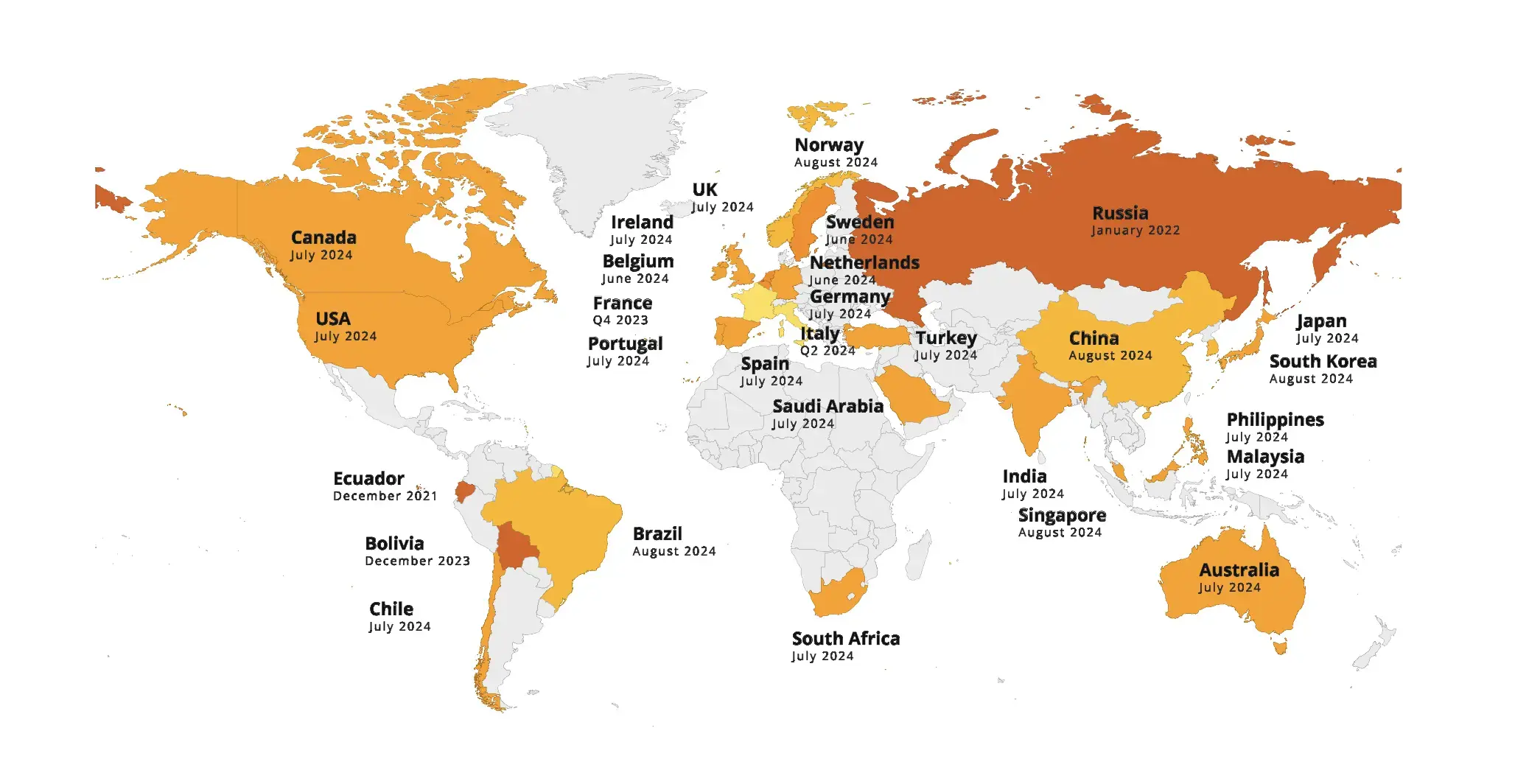

The Scope of the Trade Data Gap

There is considerable darkness in the trade universe. For instance, Ecuador hasn’t updated its export data since December 2021, and Russia stopped reporting in early 2022. Taiwan and other nations choose to report only aggregate numbers not broken out by country or product. Non-reporting along with the partially reporting countries keep 15% of global trade, or $4.8 trillion in goods and services in the shadows.

How Mirror Data Fills the Void

Mirror data penetrates the shadows using a straightforward principle: every export from one country represents an import to another. By analyzing import data from prompt and detailed disclosing traders such as the U.S., China, Germany, and Japan, a picture can be inferred about the export activities of nations that keep their data under wraps.

So while an oil producer may delay reporting its exports, China, Spain, the United States, and other key importers of that nation’s oil, report precise import records. They enable us to estimate export volumes, market destinations, and even regional and company-specific trends, illuminating once hidden trade flows.

Case Study: Real World use of Mirror Data

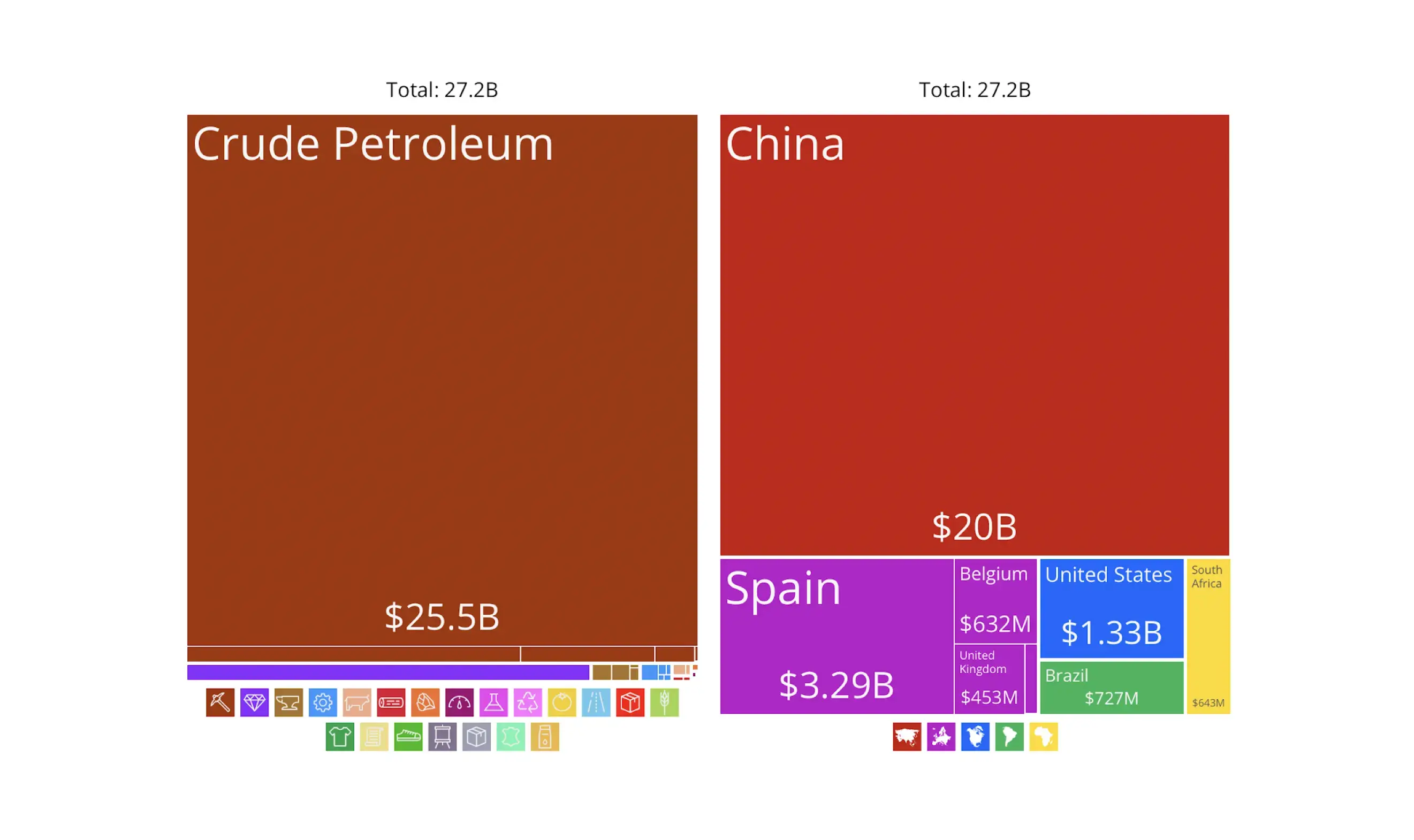

- Angolan Oil: Despite Angola’s delayed reporting, mirror data shows that its oil exports remained stable in 2024. Import records from China, Spain, and the United States, which account for over 63% of Angola’s oil exports, indicate approximately 275 million barrels were imported in the last year, valued at around $25.5 billion. These records allow us to monitor Angola’s export flows and estimate volumes even without direct national reporting.

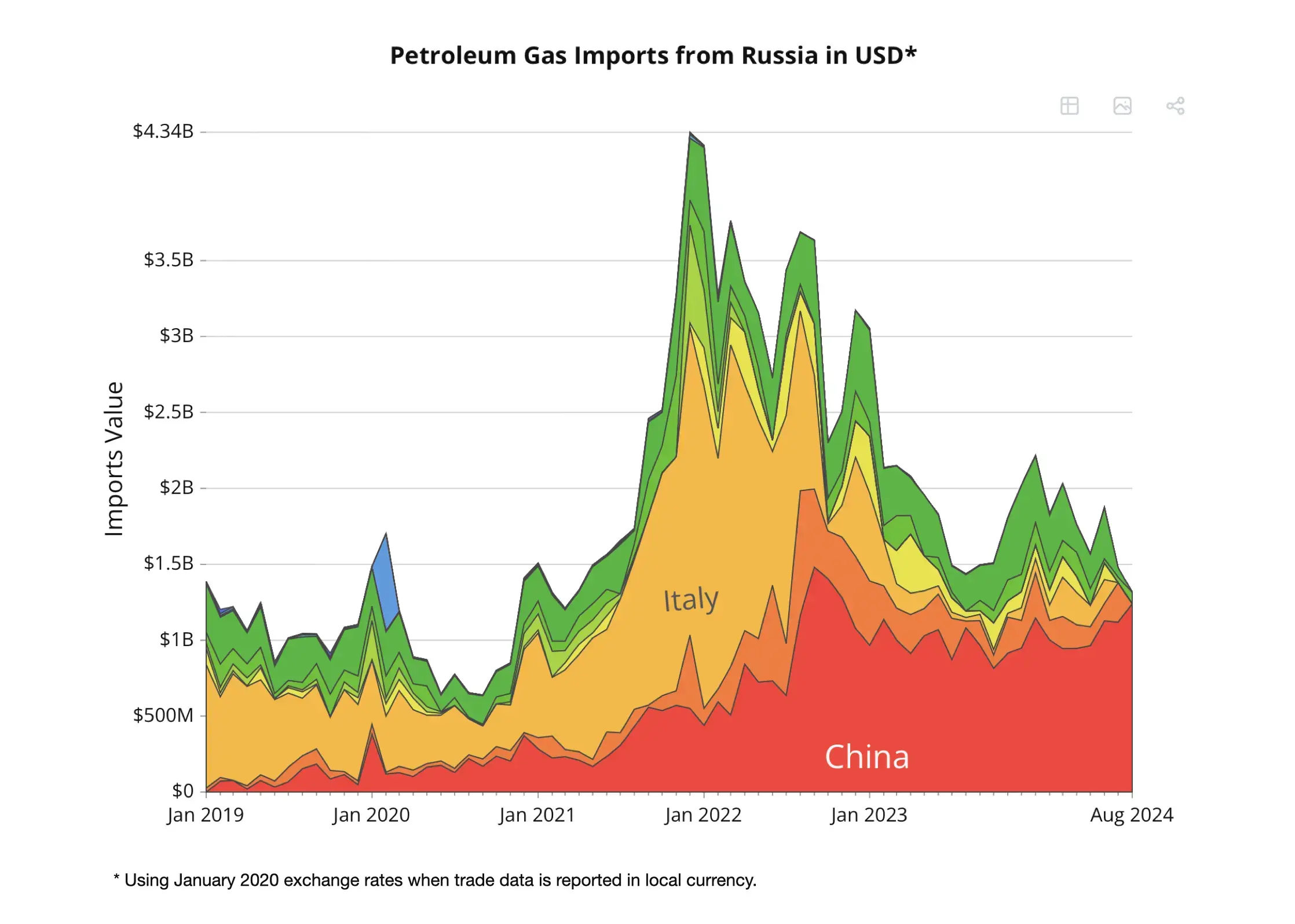

- Russian Natural Gas A State Secret Revealed: Russia stopped reporting trade data after it invaded Ukraine in early 2022, but mirror data from Europe and China, major importers of Russian natural gas, reveal a 70% decline in exports in 2024 compared to pre-invasion levels. Import data show Europe and China imported around 125 billion cubic meters of natural gas from Russia in the first half of 2024, valued at $35 billion. This allows us to maintain visibility into Russia’s trade despite the absence of direct reporting.

Enhancing Global Trade Coverage

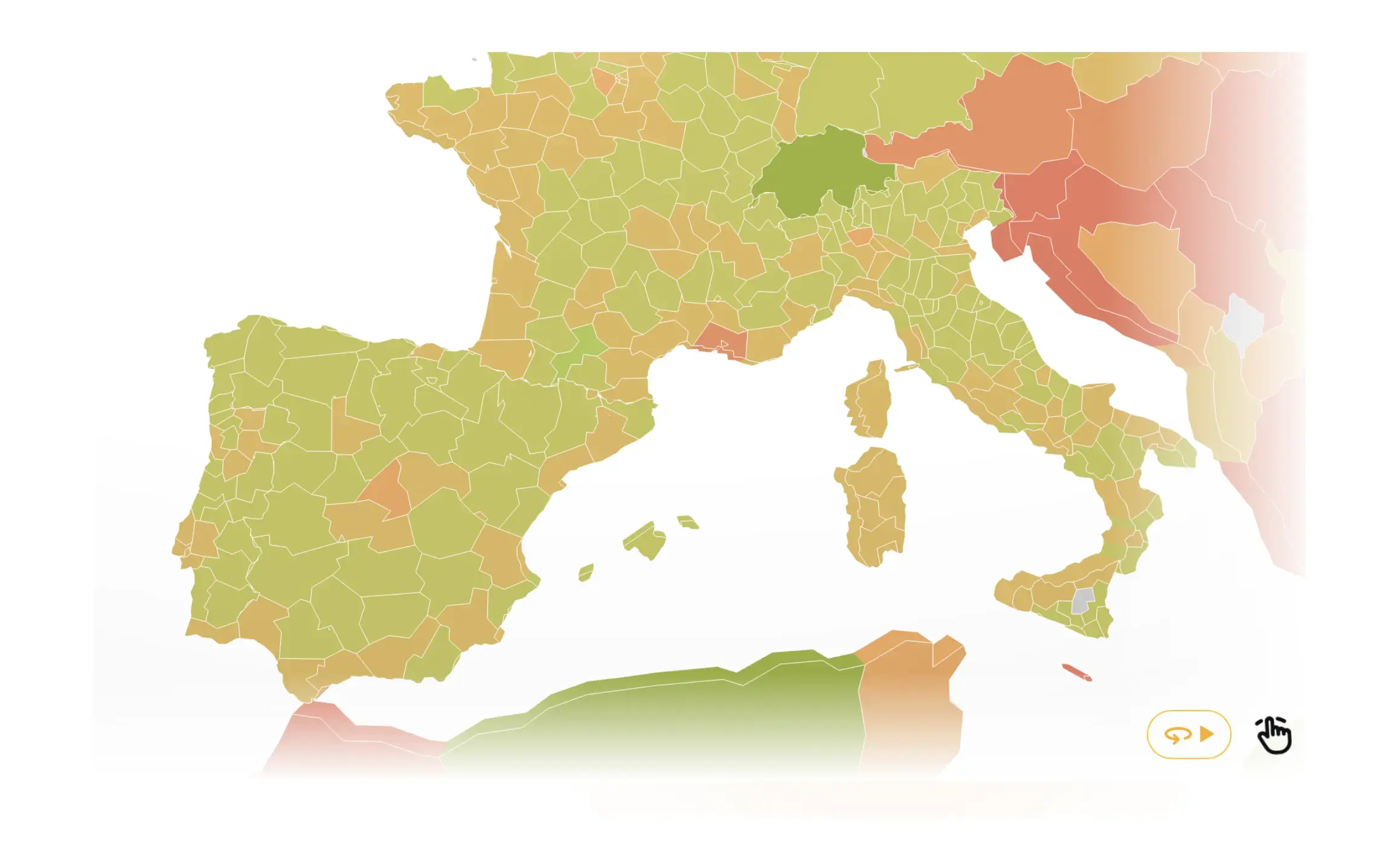

Mirror data on the OEC has increased global trade coverage from around 60% to over 85% in the past year, and we continue to expand. Recently, we added data from Portugal and Italy, with sub-national disaggregation. This enhanced global dataset provides businesses, policymakers, and researchers with deeper insights for making more informed decisions. Mirror data has a growing track record of filling critical gaps in reporting that can obscure our image of the trade universe.

From Opaque toward Transparency

Mirror data can be powerful in monitoring regions notorious for reporting delays. In Africa, while South Africa is the only country providing timely disaggregated trade data, using mirror data, we can pull back the curtain on the rest of Africa to reveal some important commodity trends:

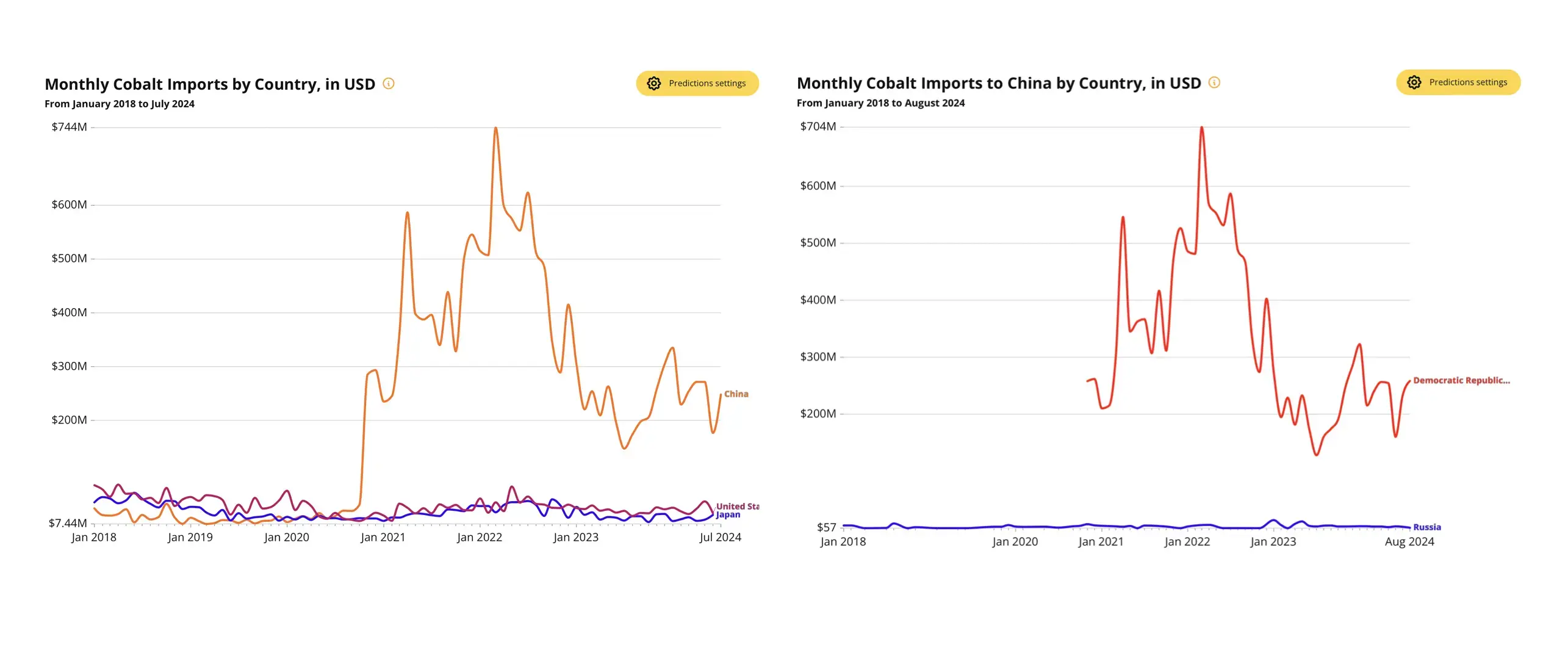

• Cobalt Exports: In 2024, African countries exported 170,000 metric tons of cobalt, accounting for 74% of global supply, based on import data from trading partners. This mirror data highlights the continent's dominant role in the mining sector.

• Trade Trends: Cobalt exports rose 17% in 2023 and continued growing in 2024, driven by key mine expansions. However, cobalt prices dropped nearly 5% by Q2 2024 as oversupply from the Democratic Republic of the Congo, Indonesia, and China weighed on the market. Regional demand insights from mirror data are reshaping forecasts and influencing industrial activity.

The Broader Implications of Mirror Data

The use of mirror data offers far-reaching benefits across various sectors:

- Supply Chain Management: Companies can anticipate potential disruptions in supply chains by tracking essential commodities through import data from partner nations.

- Market Analysis: Investors and analysts gain critical insights into emerging markets and regional trends, even in areas where direct data is incomplete or delayed.

Economic Stability: Governments can better detect trade imbalances, smuggling, or other illicit activities, allowing for more proactive policy responses.

Conclusion: A Clearer View of Global Trade

Mirror data bridges the gap in global trade reporting caused by delays or non-reporting. By leveraging the import data of countries representing over 85% of global trade, the OEC provides a clearer, more comprehensive picture of international commerce.

Mirror data ensures that no country’s trade activities remain entirely hidden. Businesses, policymakers, and researchers are empowered to navigate global markets confidently, making informed decisions to drive economic growth and stability.

At the OEC, we remain committed to enhancing data transparency and accessibility. By continuously refining our methodologies and expanding our datasets, we aim to illuminate the complexities of global trade probing ever deeper into the darkest shadows of the global economy.