Amid Escalating Mortgage Crisis, China Sees a 15% Decline in June Imports of Residential Construction Materials

It started with China's real estate bonds falling due to the country's property debt crisis last December. Now, thousands of people around China are refusing to make mortgage payments for homes yet to finish. As China’s mortgage crisis deepens, it creates a crater that threatens exporters everywhere.

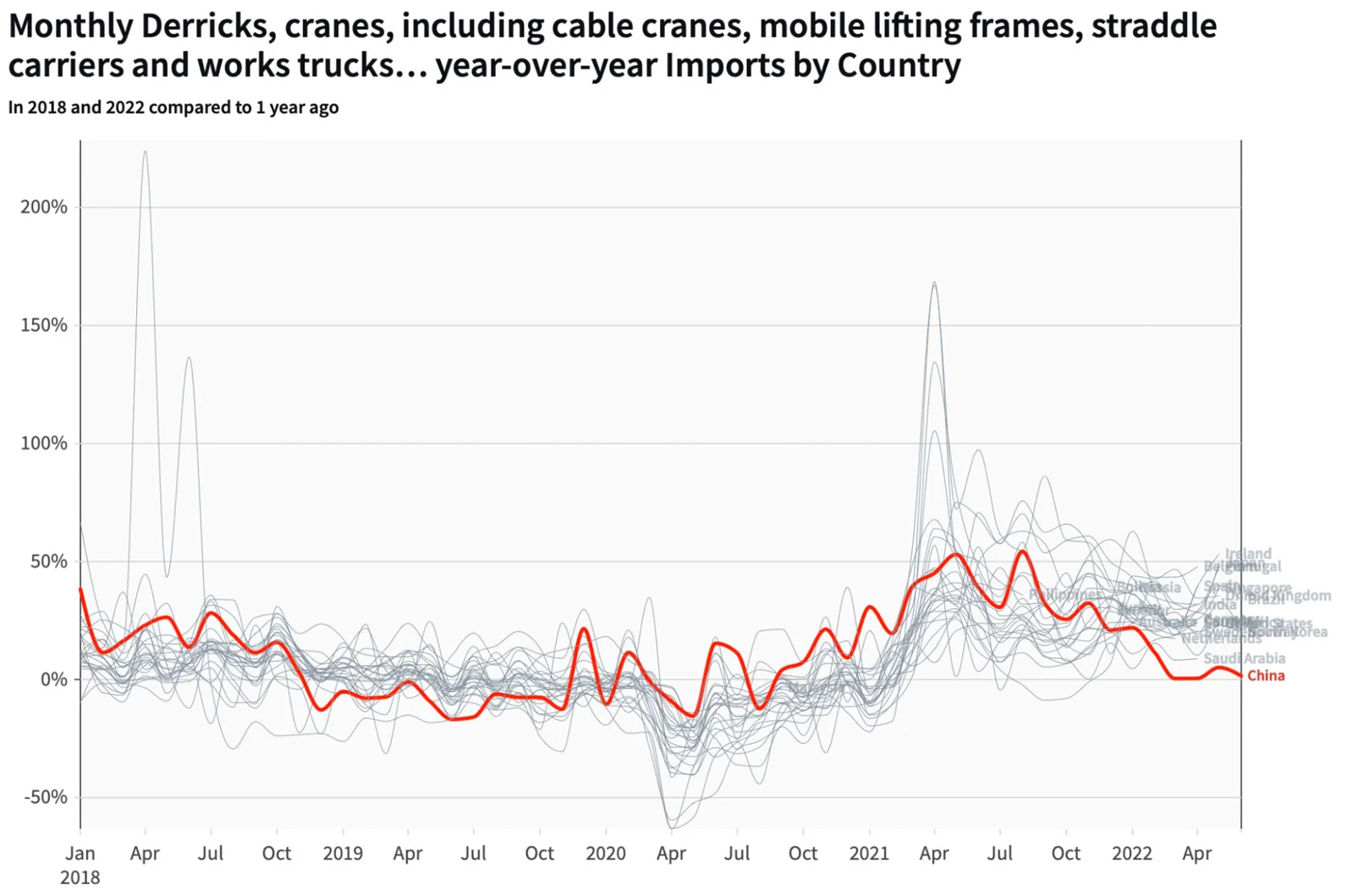

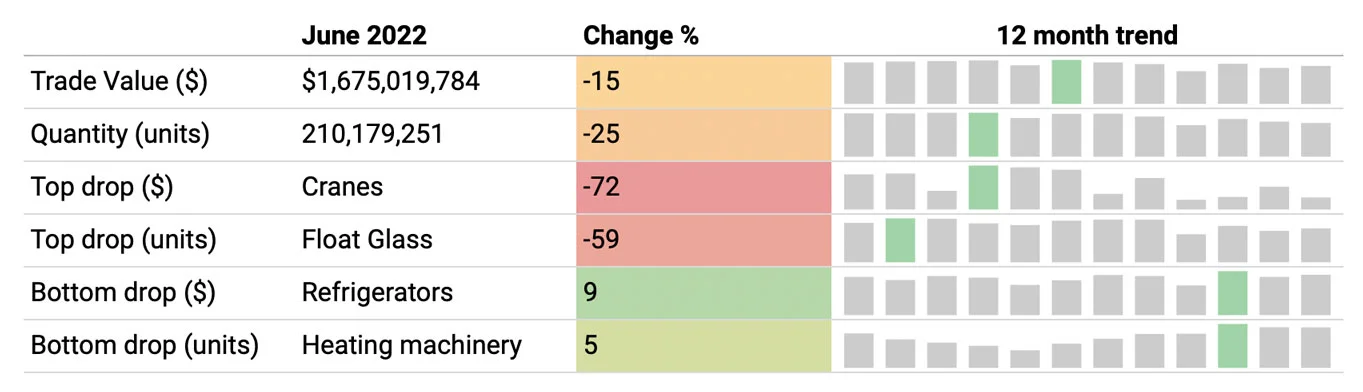

The mortgage crisis is affecting imports of new residential construction products into China, one of the world's largest markets. Imports of these products slipped by 15% in June compared to the year before. Moreover, recently released trade data shows that imports have fallen from -72% (cranes) to -9% (air pumps) among those with the most significant imports.

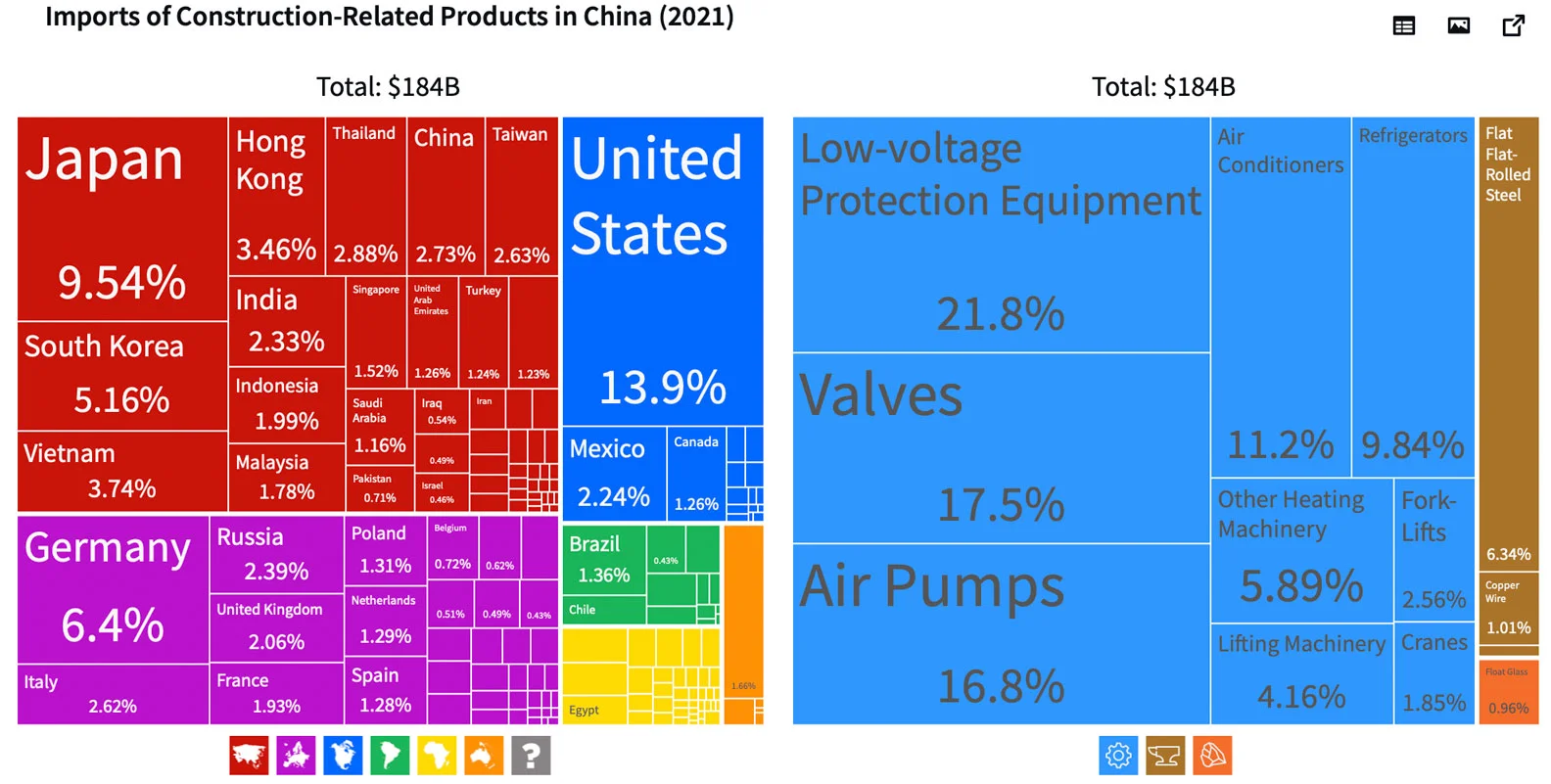

Thirteen products traditionally form the bulk of China's imports in the new residential construction universe, with $180B in imports during 2021. For decades, China's booming construction sector has provided a growing market to exporters in more than sixty countries. But as mortgage market value is falling and the demand for products associated with the construction of new homes shrinks, these exporters might be unable to find the same returns as before.

China's imports of new residential construction products have fallen by 15% on average. With China's total imports up by nearly ↑ $3.83B (1.67%), the real estate market shows early signs of a slowdown. Measured by quantity (number of packages or kilograms), imports in June are down by -25% year-on-year.

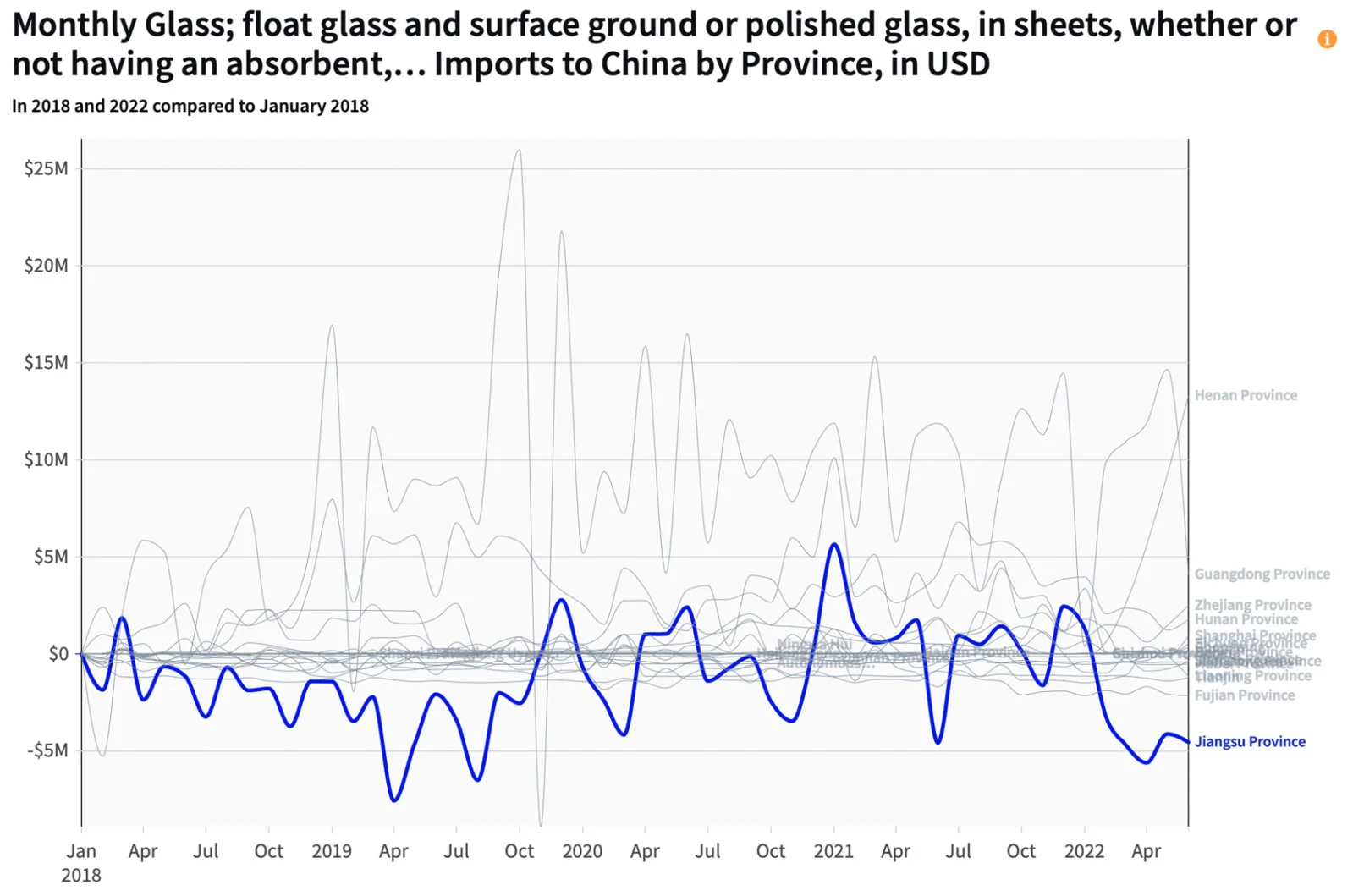

For example, Float Glass, primarily used for windows, doors, and facades, decreased by ↓ -$1.49M (-2.9%) and by -66% as measured by the number of packages imported; the difference is the price increase. In 2020, China accounted for 8% of Float Glass global imports.

China's mortgage crisis has resulted in plummeting imports of Fork Lifts (-58.17%), Heating Machinery (-30.46%), and Air Pumps (-13.5%) after receiving a spate of downgrades from homeowners in small Chinese cities battling a rare property market downdraft. Likewise, China's property debt crisis has resulted in plummeting imports from Japan, South Korea, the U.S., and Europe after they account for two-thirds of total exports of construction-related products to China.

China Evergrande, the world's most indebted property developer, defaulted on its debt last December. Its fallout spread to other developers across the country.

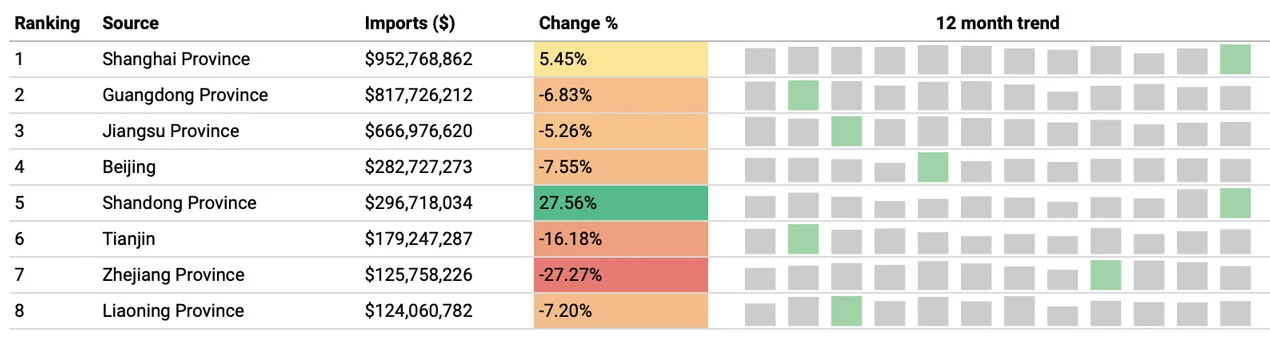

Moody expects more developers in China to default on debt this year — half of the firms under review for downgrade or have a negative outlook. In addition, recent trade data shows China's real estate market remains subdued. Smaller cities in provinces like Jiangsu and Zhejiang and Liaoning have been hammered by falling imports, the latest trade data by China's statistics bureau shows.

Imports growth for new residential construction products is concentrated in the top fastest-growing 70 cities, where imports are down 34% from a year ago in June. For example, the slowdown has hit the glass-making industry, with -72% fewer imports from Guandong, as measured by quantity (↓ -$5.87M, -55.6%).

China faces a homebuyer crisis, as 80% of residential housing is built with prepaid schemes. So even if the central bail-ins or bailouts homeowners, it'd be challenging to do so without lowering mortgage rates. According to Bloomberg, China's property sector accounts for about 25% of its GDP, with 70% of household wealth stored in the property.