The UAW Strike Aims to Demonstrate Labor's Global Impact

From the heart of Detroit to the bustling trade hubs in the Southern US, a labor union's strategy of gradual strike expansion slowly turns the screws on industry at a time of unprecedented change and potential vulnerability for the auto giants.

The Crux of the Matter

The labor landscape in the US automotive sector has been jolted by the United Auto Workers (UAW) union's decision to widen its strike efforts at crucial automotive facilities, putting gradual pressure on labor negotiations. Ford, General Motors, and European based Stellantis (home of Chrysler-Fiat) may have been caught off guard by this approach. As the dispute drags on the union's strategic maneuvers, promise broader geopolitical and economic ramifications than the demands for increased pay, a shorter work week and more benefits.

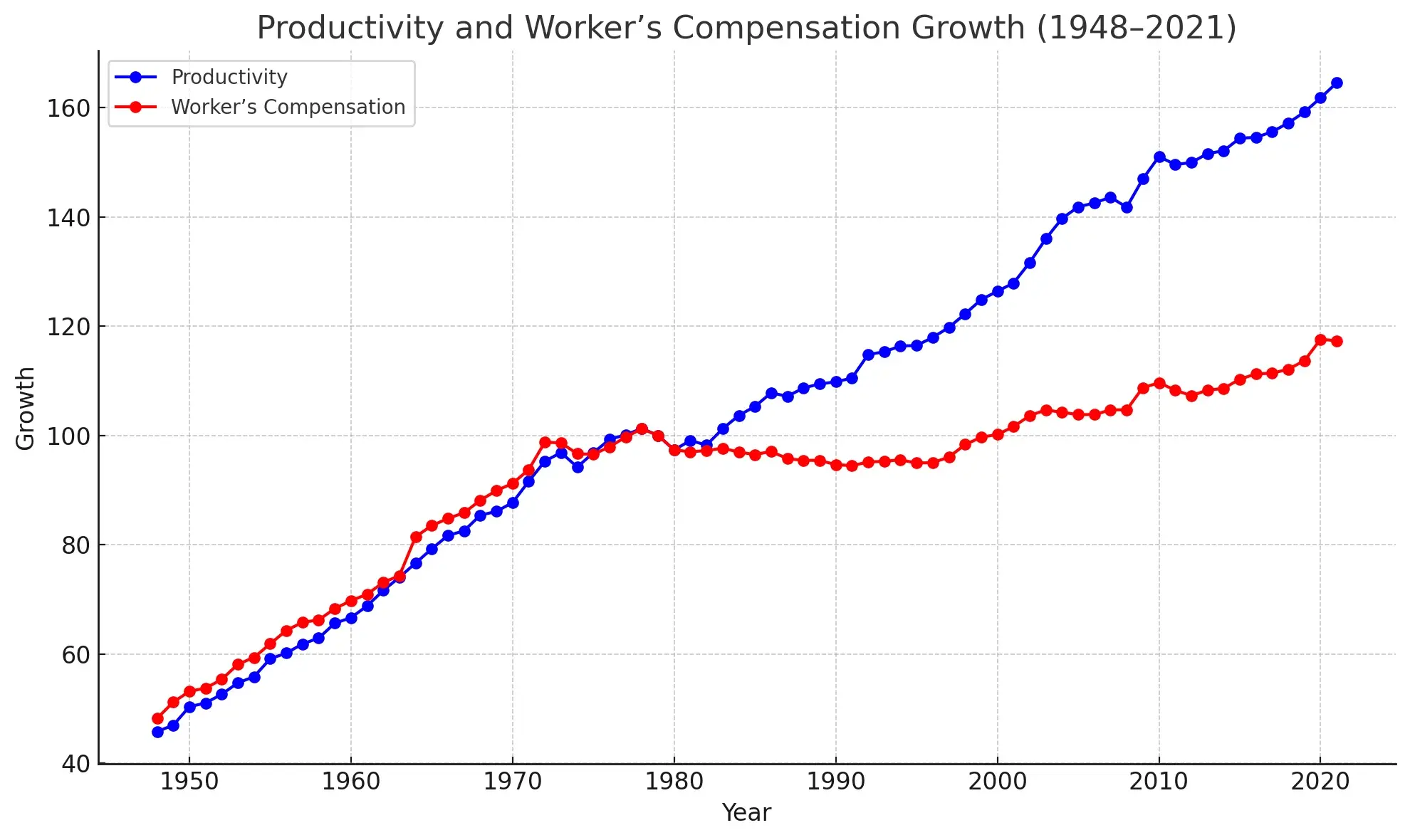

Fifteen years after the bailout of the auto industry by the Federal Government, which shrank the size of the unionized workforce, the trend of worker and management pay has widened. Between 1978 and 2019, CEO earnings rose1,167%, compared to the 13.7% average gain for manufacturing workers. The years immediately following the bailout have been good for management and stagnant for workers. Between 2013 and 2022, execs enjoyed a 40% pay hike, while workers compensation stalled despite soaring productivity gains during the same period.

As demand for electric vehicles grows, labor management tensions around technology and job security loom larger.

The shift to EVs, with their fewer moving parts and outsourced components curtails assembly time and jobs, potentially trimming workforce numbers. EV automation could reconfigure the labor needs at a time when vehicle prices have never been greater. While manufacturing productivity for internal combustion vehicles has grown for decades, non-union Tesla's success with robotics and automation is an incentive for the UAW to be aggressive now while it still has leverage in a crucial industry transition.

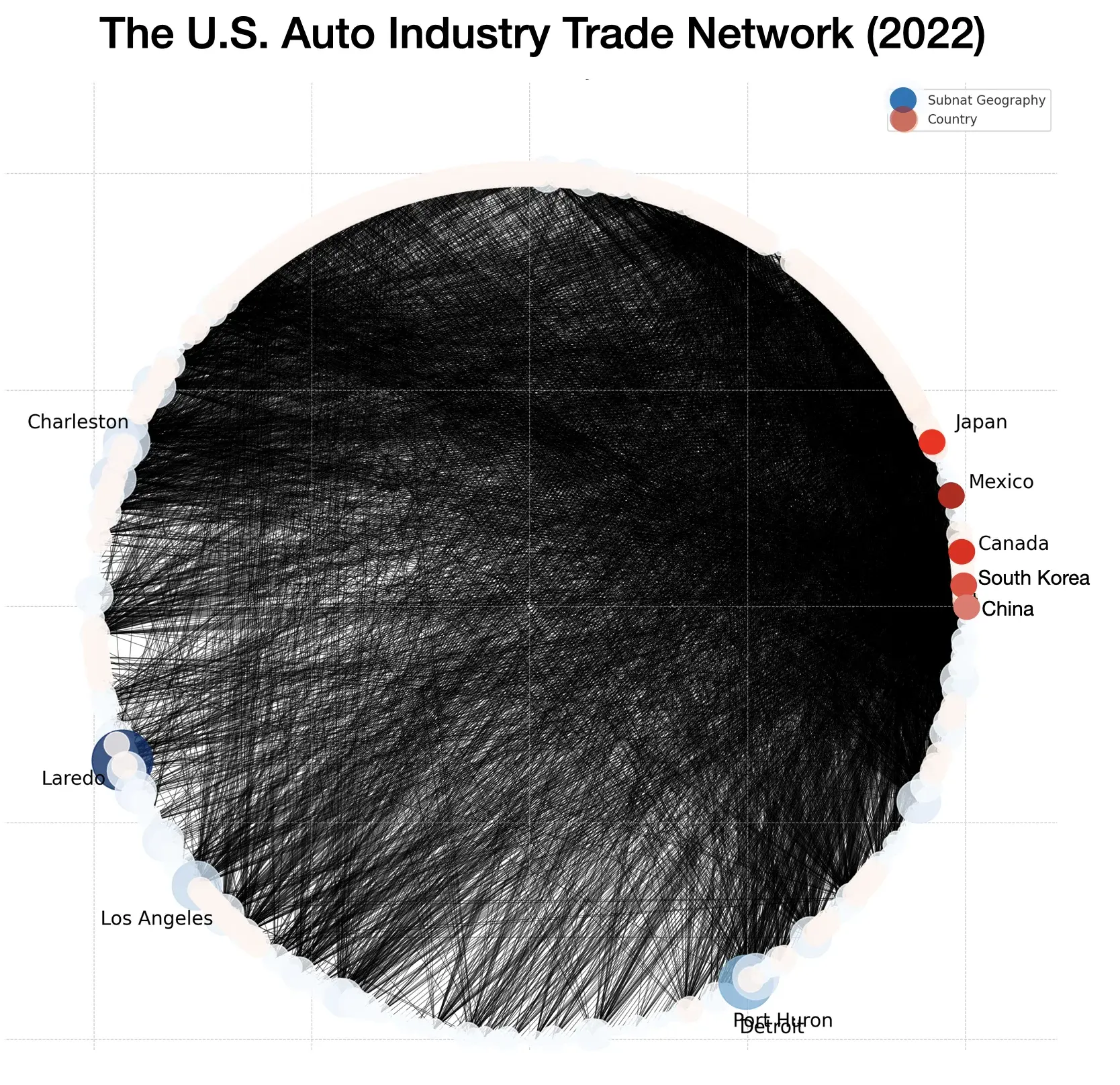

Ripple Effects: From Detroit to Global Trade Hubs

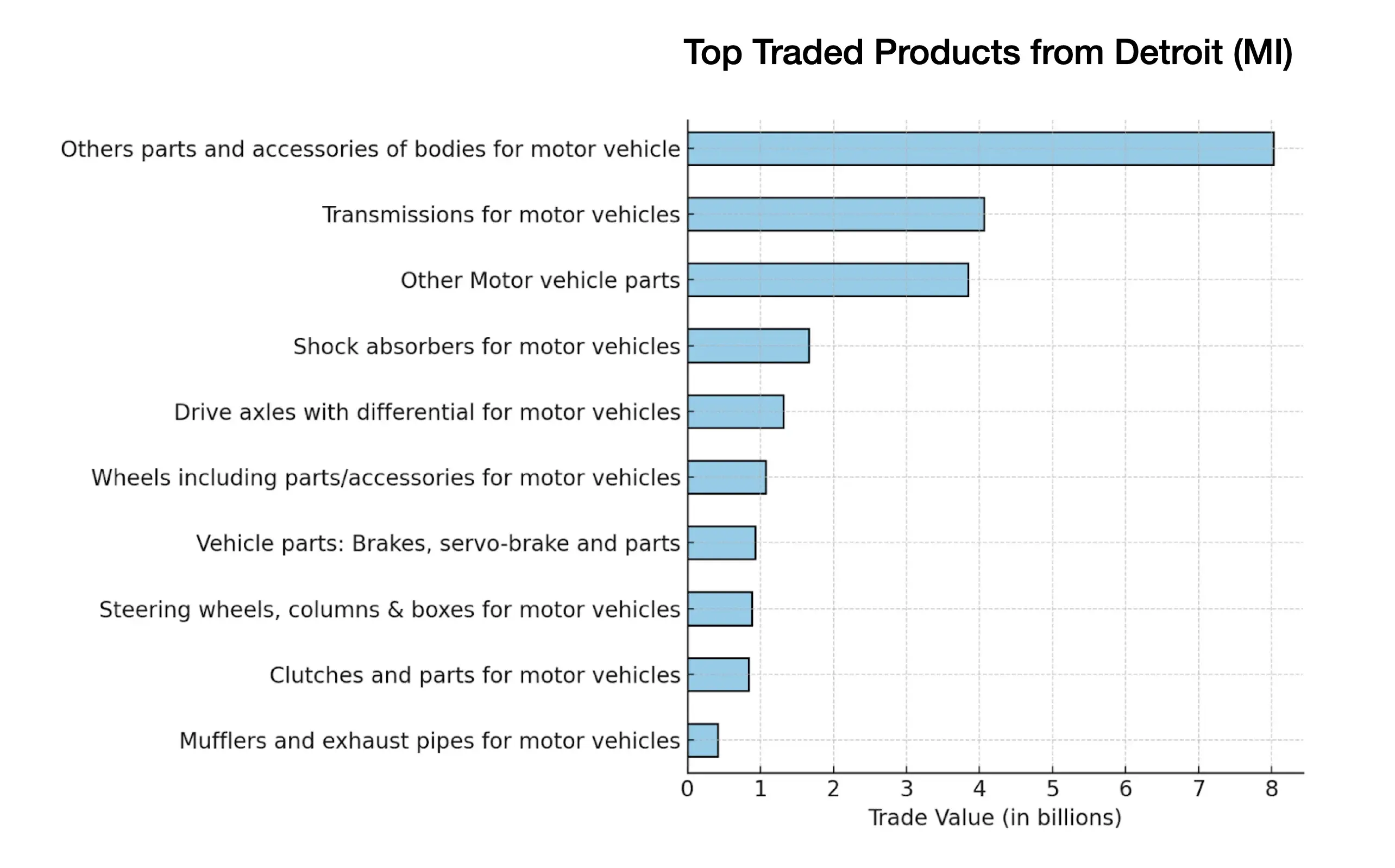

An evolution of the US auto industry to a more decentralized or “less Detroit-centric” operation has had an unexpected effect on the labor management narrative. Detroit remains a center for making motor vehicle body parts and transmissions. The Port of Detroit accounts for 21.87% of the total U.S. trade for motor vehicle body parts and accessories and 15.32% for vehicle transmissions. A disruption here directly affects domestic supply, but also creates a ripple effect with potential impact in Asian markets where Japanese and Korean automakers have become crucial Detroit suppliers.

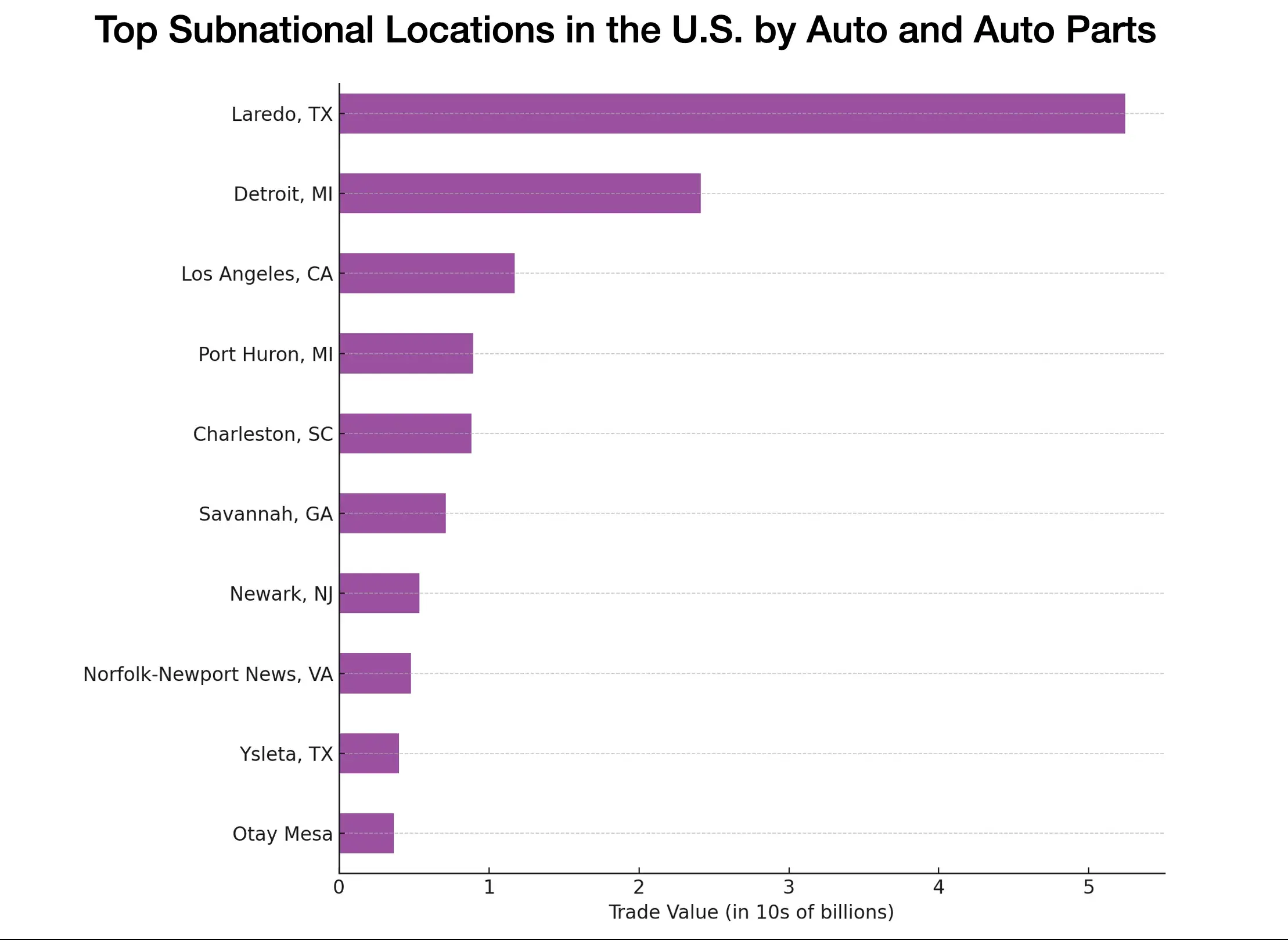

The UAW is now considering the targeting of critical trade hubs, shifting from its initial focus on Detroit based parts distribution centers. Setting sights on Texas, Mississippi, and Tennessee plants could produce substantial waves to global trading and the potential to resonate worldwide.

Here's how a disruption in Detroit could also impact Japanese and Korean automakers operating in the U.S., potentially straining supply chains and the availability of Asian products in the U.S. market.

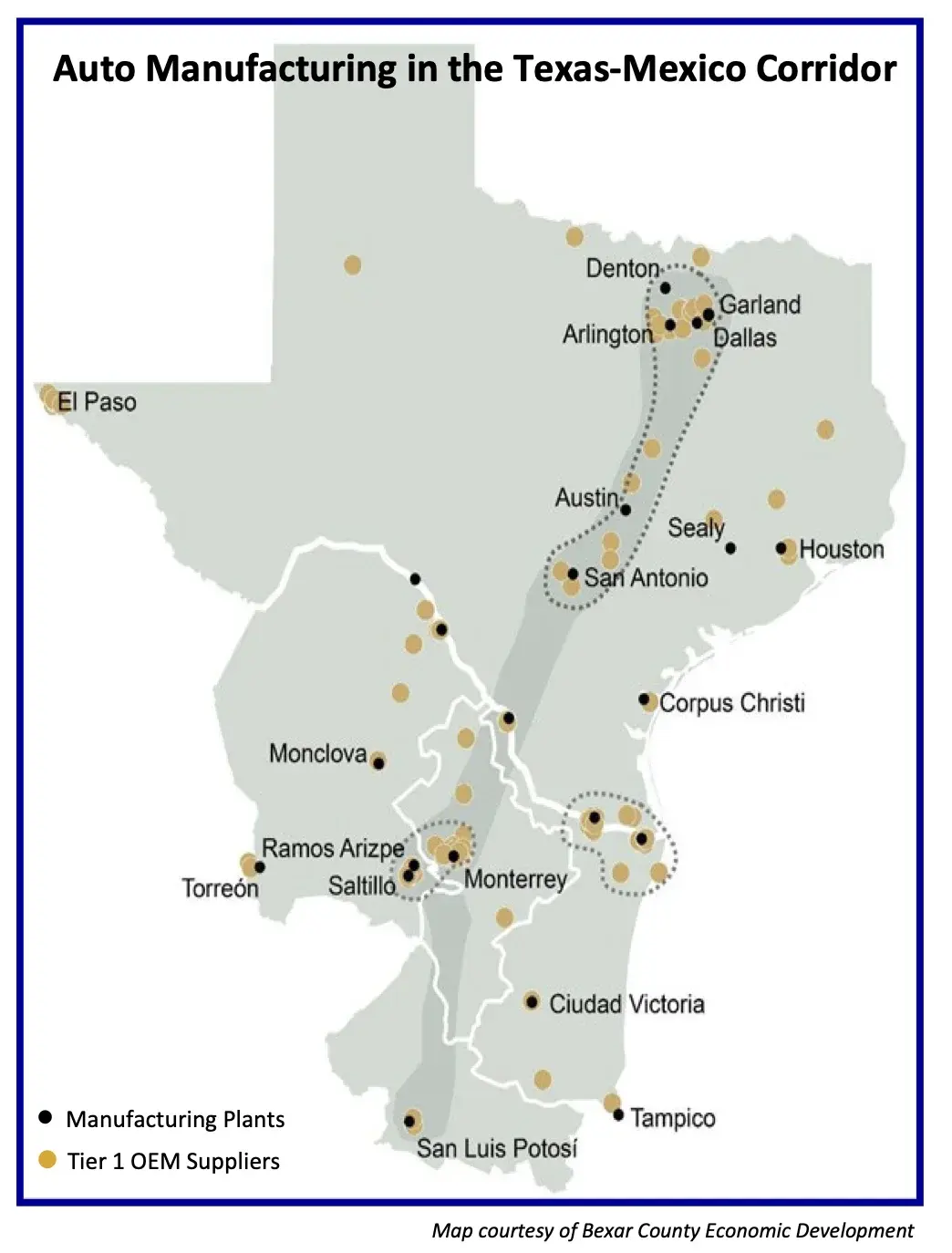

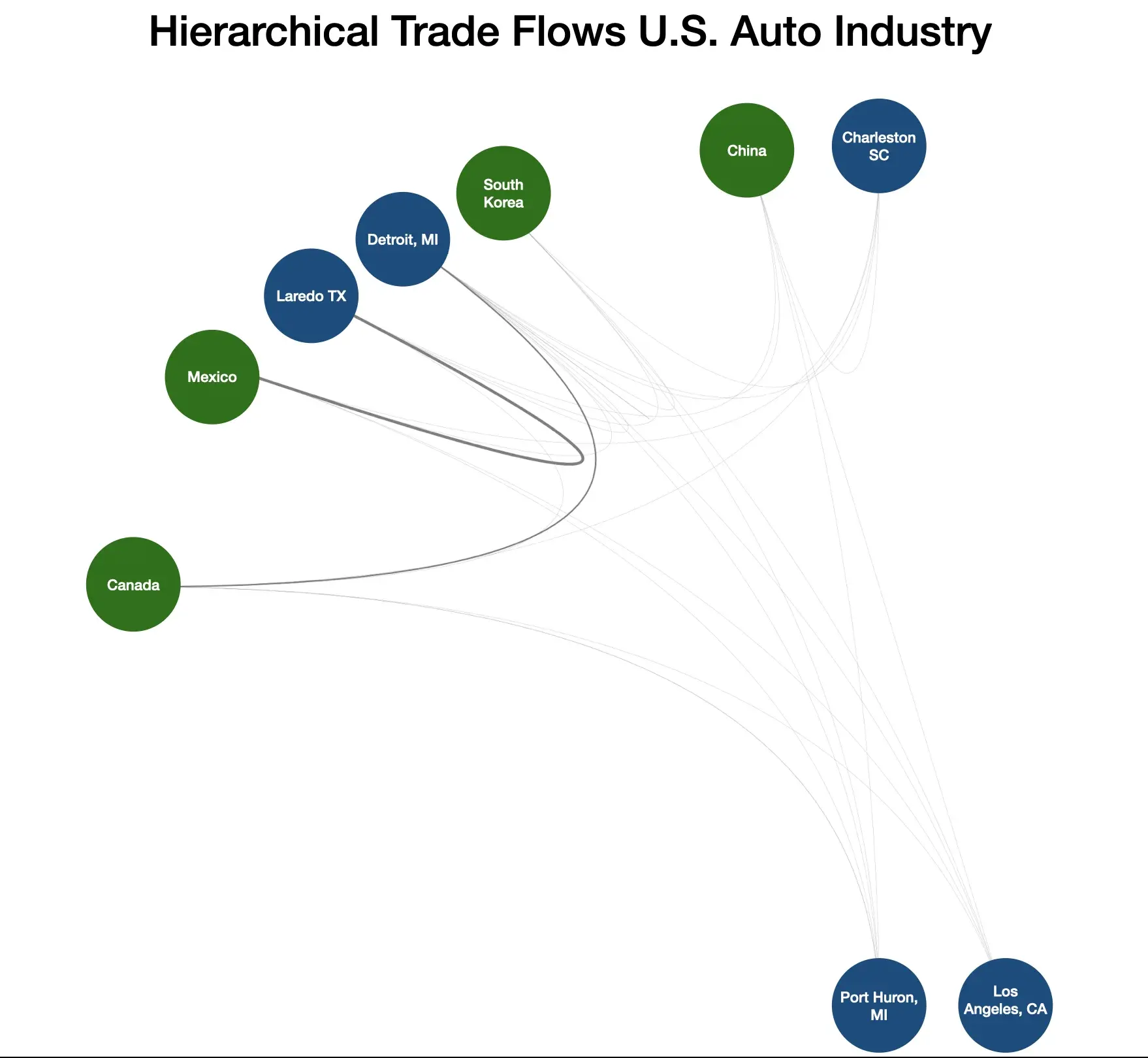

Centers at the corridor between Laredo and Dallas in TX — a significant hub with a trade value of approximately $50 billion annually — connect with Mexico, South Korea, and China. These uneasy trade partners could add to the Union pressure on US industry leaders showing a new kind of leverage from labor.

Here you can see how a strike in the Laredo corridor could significantly cripple U.S.-Mexico trade and disrupt one of the most important global hubs for automotive manufacturing.

Similarly, Port Huron, MI, another significant port, accentuates Canada's role as a major trading partner. Any interruption here could reverberate across the U.S.-Canada border, affecting the two nations' deeply integrated auto industry.

Broader Implications: Beyond Borders and Industries

The industrial actions reach beyond immediate economic losses, estimated to be over $1.6 billion, and about 6,000 layoffs. The global dimensions already discussed raise the economic stakes significantly in Canada, Germany, South Korea and beyond.

Canada's deeply integrated auto industry with the U.S. places it in a vulnerable position, with a trade value of $15.19 billion hanging in the balance. South Korea's connection to Detroit is valued at $920.77 million. Disrupting the seamless operations of Korean automakers in the U.S. is a big pressure point for Detroit by hampering the consumer shift towards electric vehicles. An anticipated vehicle shortage and consequent price surge could deter consumers from investing in electric vehicles, a setback for global sustainability as well as Detroit's bottom line and numerous enterprises in Tennessee, Texas, Cleveland, OH, and New York, NY.

Navigating the Future Landscape

Why does all this matter? A heart attack in the U.S. auto industry would not be fatal but it would permanently affect “business as usual” across the country and the world. The auto industry is a global network, with parts and products moving between countries everywhere on the planet. In this UAW action the union may understand the 21st century auto industry somewhat better than executives in Detroit. One thing is certain, in this labor management conflict, the whole world is watching to see if the transition to electric mobility will accommodate both environmental and labor aspirations.