Will New Export Controls Hinder China's Progress in High-End AI Chip Development?

The US government has imposed new export controls to limit China's development of high-end chips with AI applications. However, even if the US government is successful in restricting the sale of specific chips and chip-making equipment to China, China would likely be able to develop high-end AI chips using other means.

The United States and China are locked in a battle over integrated circuits, the tiny chips that power everything from smartphones to military hardware.

The fight for mainly smaller and faster chips has significant implications for the global technology industry and is only getting started.

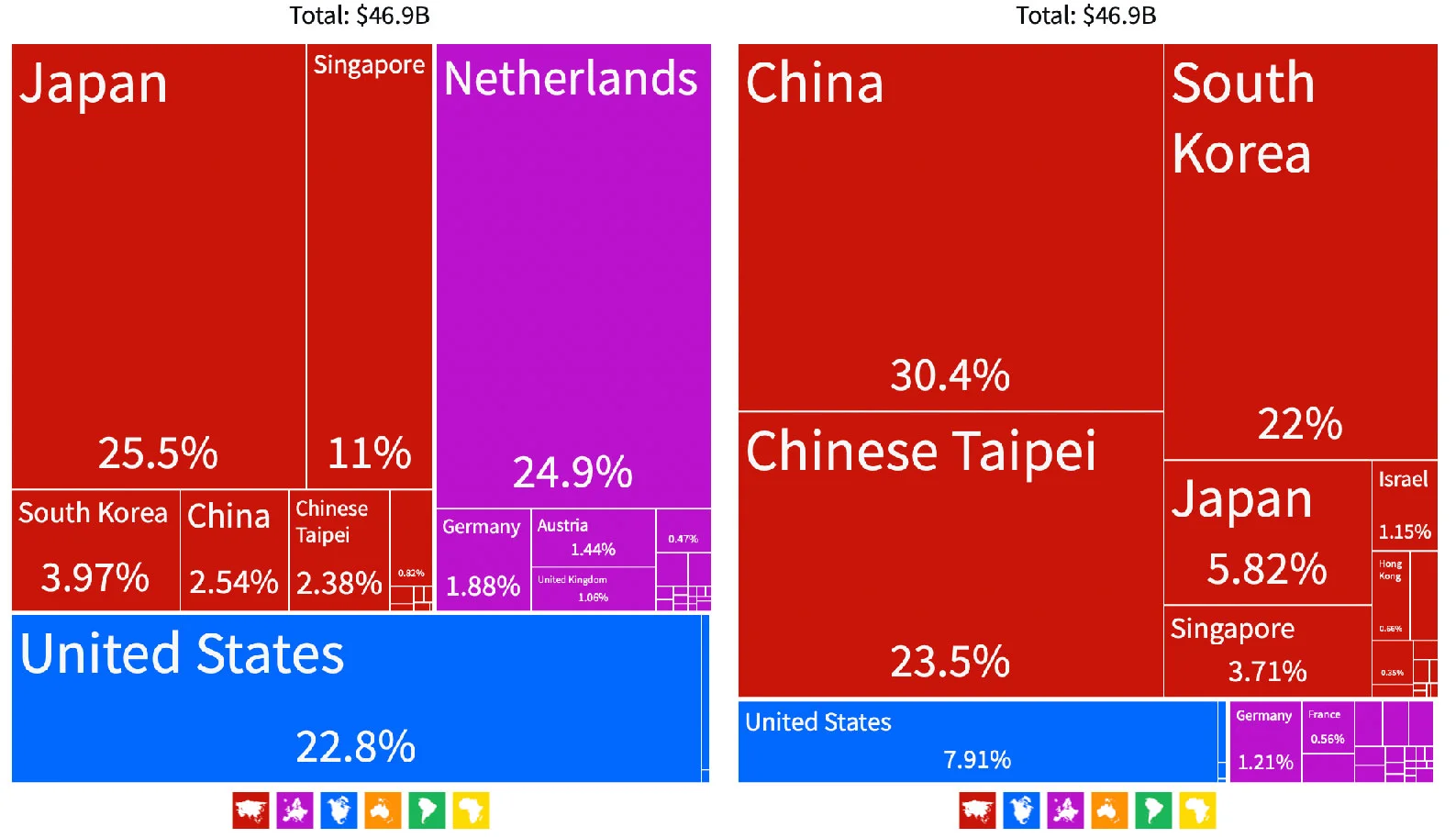

The United States and China are the world's largest markets for the most advanced chips. However, Taiwan has long been the leading manufacturer -using designs and technologies developed in a handful of western countries. But China is catching up fast and is eager to become the dominant player in the most advanced chips.

The battle for advanced chips is being fought on multiple fronts. The U.S government is trying to block Chinese entities from buying advanced computer technology, while the Chinese government is investing billions of dollars in building its semiconductor industry.

In August 2022, China imported more integrated circuits (33.3B) than crude oil (30.5B).

The Biden administration is concerned that China is using U.S. technology to bolster its military and gain an edge in the race to develop artificial intelligence (AI).

Not just the U.S. and China are involved in this war. Taiwan, South Korea, the Netherlands, and Japan are significant players in the advanced semiconductor industry, and they're caught in the middle of the U.S.-China dispute.

The United States and its allies are at the forefront of the advanced chip supply chain, while China lags. American firms design some of the most sophisticated chips, such as Apple's M1 Ultra Chip, while US-allied nations supply essential equipment, resources, and manufacturing skills to mass produce them. However, China is rapidly catching up.

Last week, the United States government announced bar exports to China of American-made manufacturing equipment needed to produce advanced chips. The new rules also bar “U.S. persons” — including American factories and Americans and U.S. green-card holders who work in foreign factories overseas — from working on advanced chips with China.

In reaction to new US export regulations, Western suppliers have begun limiting their relations with some Chinese chipmakers.

Take, for example, the Dutch company ASLM, the only organization with the technology to make the machines using extreme ultraviolet (EUV) lithography to mass produce the highly complex foundation layers of the most advanced microchips (7 nm, 5 nm, and 3 nm nodes) in the World. The new regulations are designed to pressure ASML to restrict sales of their unique technology to China.

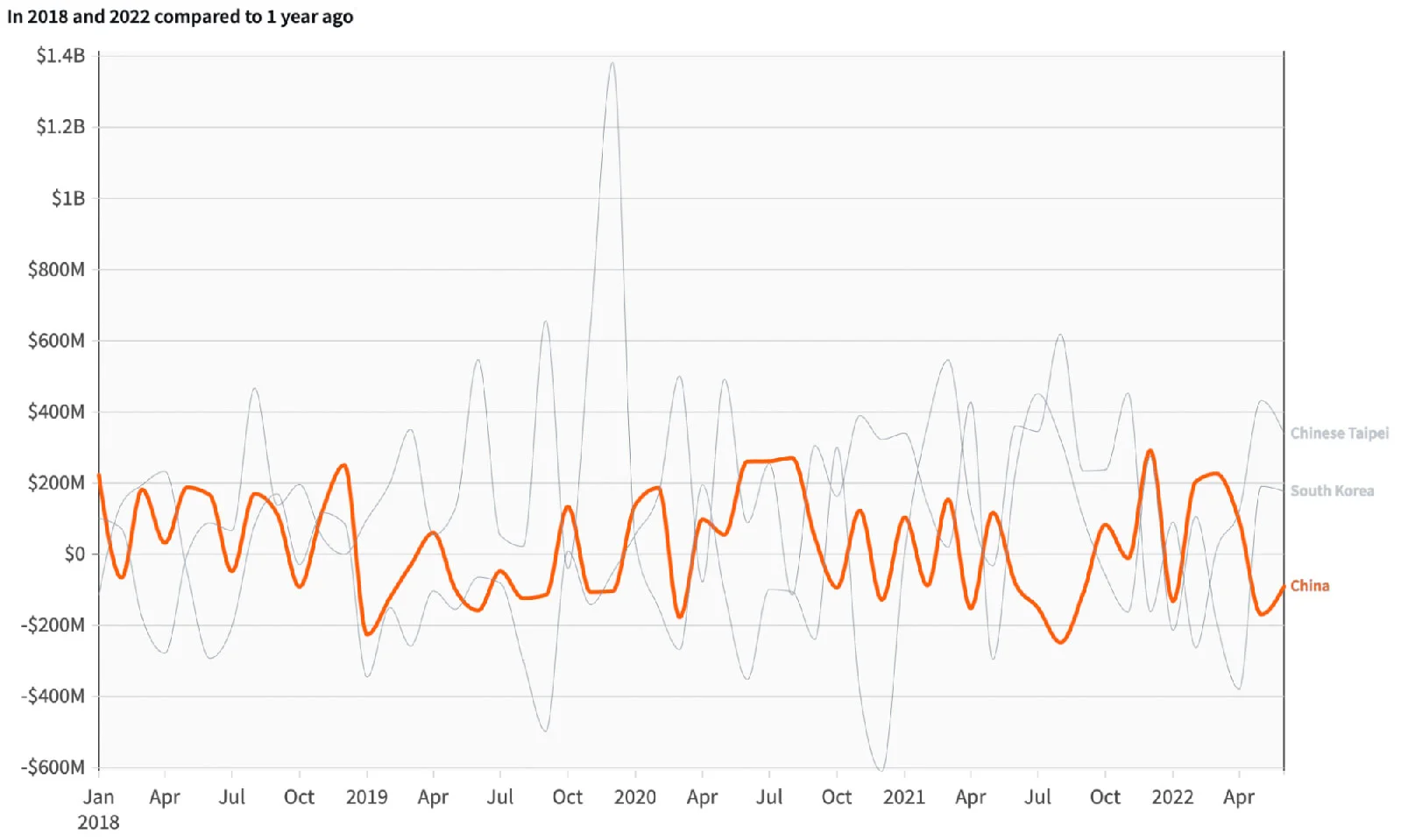

Monthly exports of machines to manufacture integrated circuits from the Netherlands

ASML's extreme ultraviolet light machine costs around $150 million, and the company can produce just 55 units annually. ASML has added manufacturing in Connecticut and California in the U.S.

Following the announcement of the new regulations, news organizations reported that ASML instructed US personnel not to install or service equipment in any Chinese chip facility. Although it is expected for Western corporations to cease shipments in the early aftermath of new US restrictions, only to resume trade at least to some extent once the regulations have been deciphered, the recent ban is among the most stringent that the US has imposed.

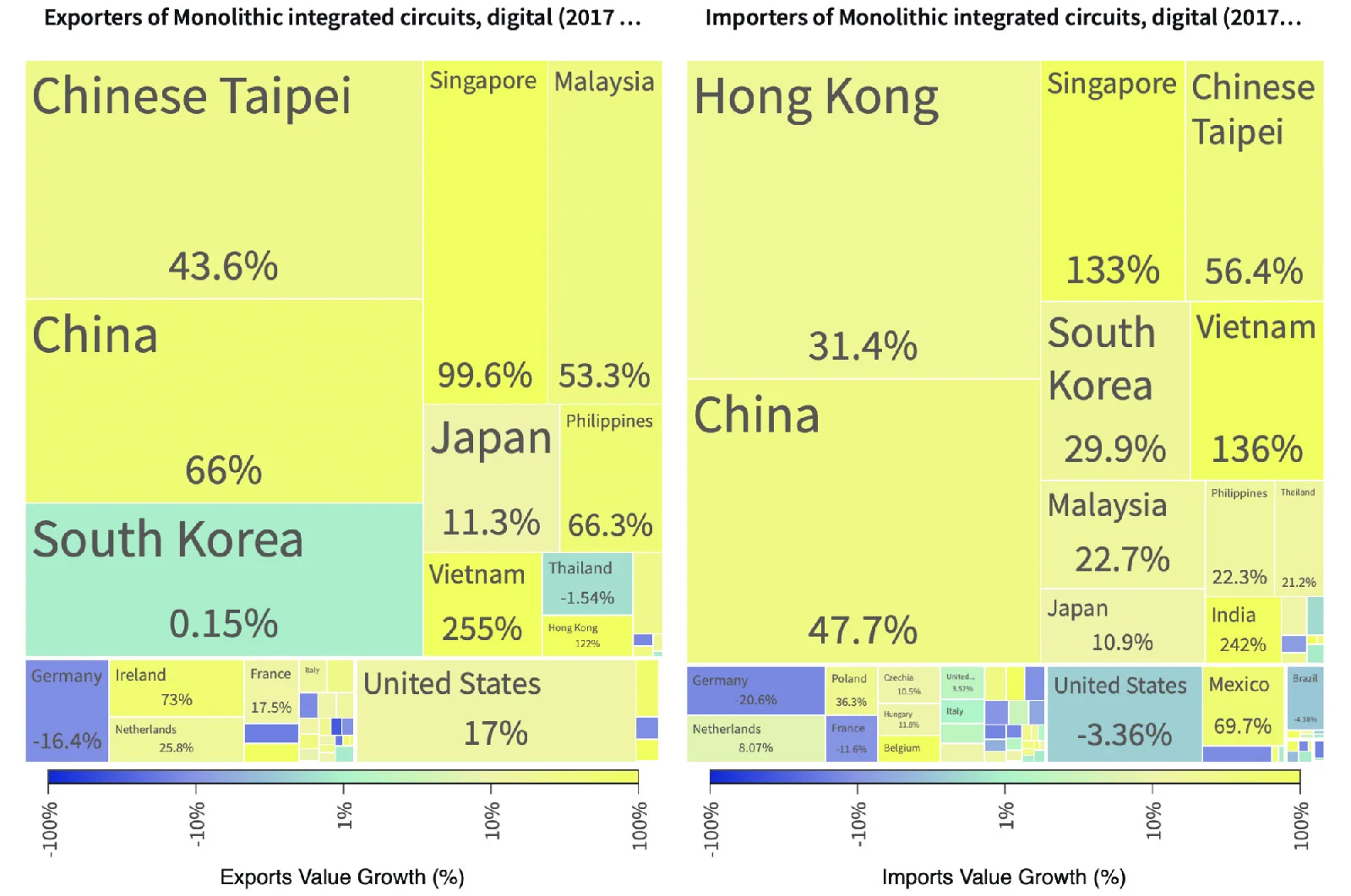

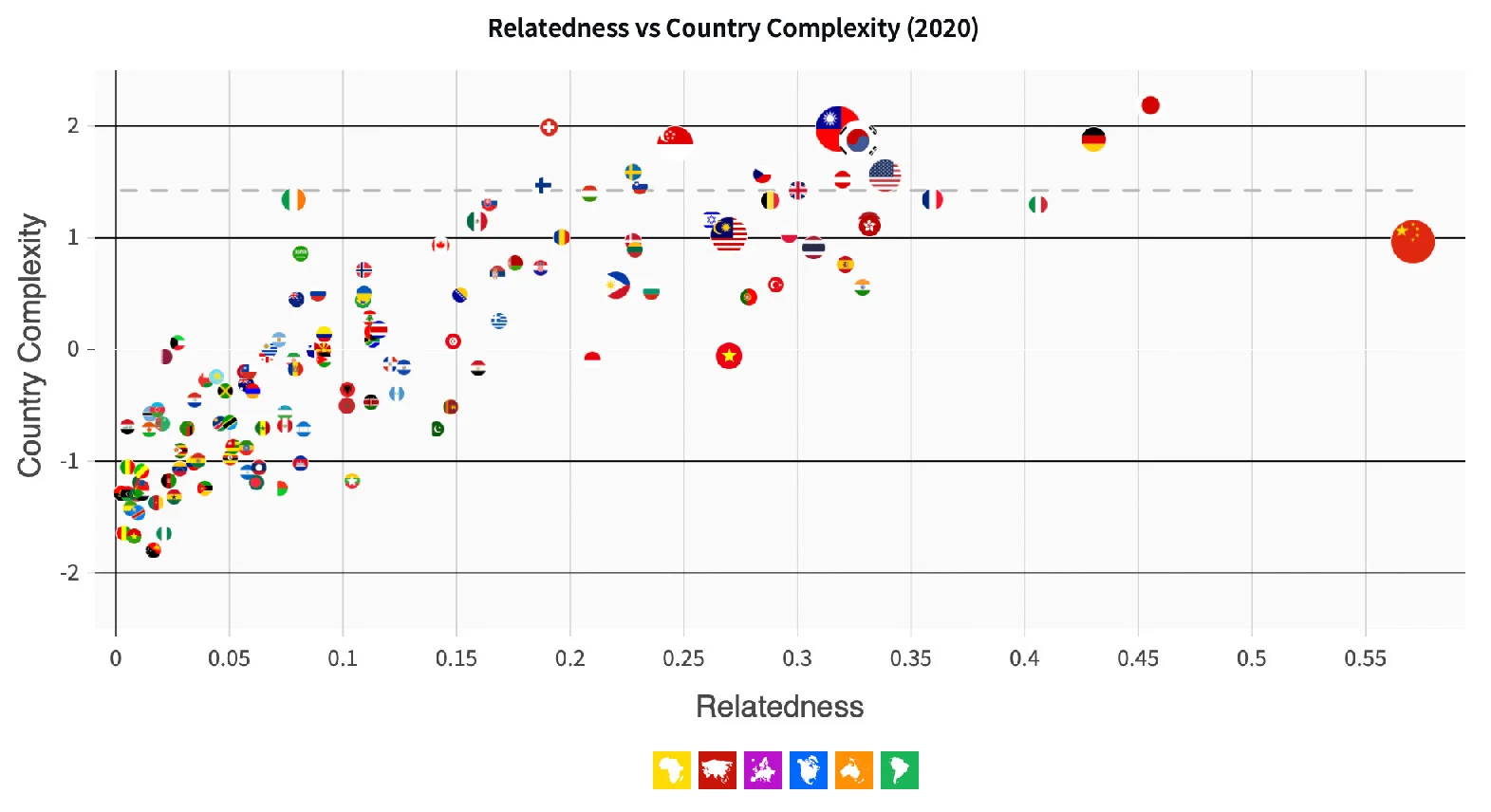

Although the U.S. sanctions are having an early impact on China's chip industry, China's chipmakers will likely find ways around the new restrictions. Over the years, China has built its skills on integrated circuits.

Relatedness is predictive of the probability that a country increases its exports of a product. To learn more, visit the complexity section of the Integrated Circuits profile page.

Still, the U.S. will likely continue to tighten the screws, making it more difficult for China to produce the most advanced chips.

But eventually, China will likely catch up to the U.S. and other Western countries in chipmaking technology. So these trade bans on advanced chips are only buying time. Meanwhile, the U.S. and China will remain locked in a battle over chips.